All About Gold Ira Companies

Wiki Article

The Facts About Gold Ira Companies Revealed

Table of ContentsGold Ira Companies for BeginnersThe 8-Minute Rule for Gold Ira CompaniesThe smart Trick of Gold Ira Companies That Nobody is DiscussingGetting The Gold Ira Companies To Work

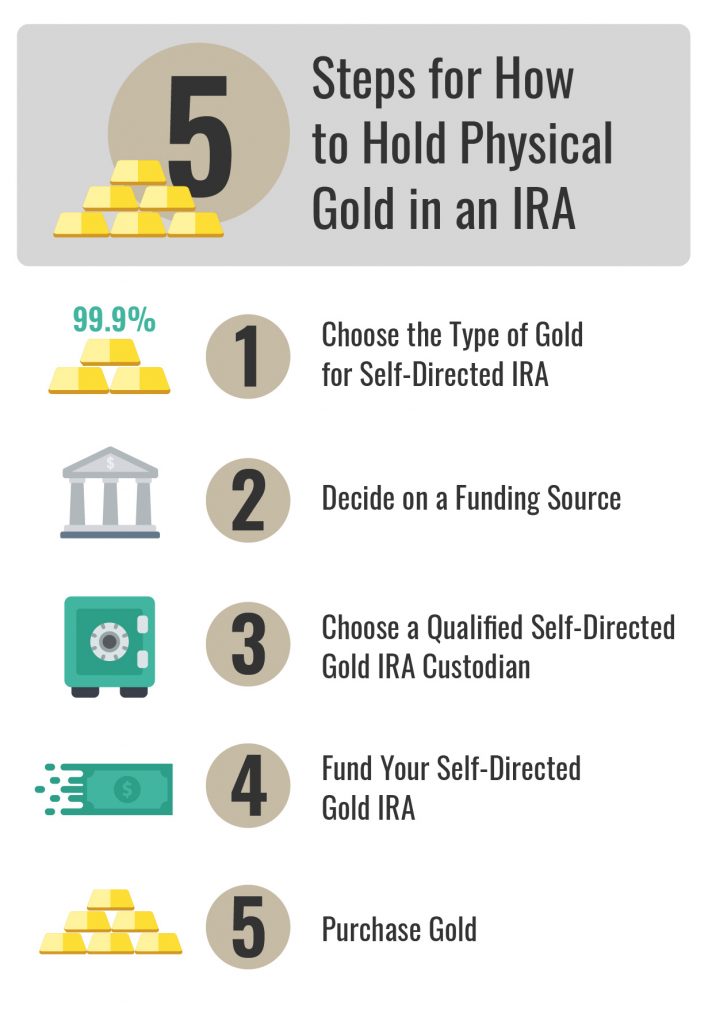

Then you require to purchase the approved gold or various other rare-earth element and have it moved to the vault in a manner the custodian can account for it," Moy explains. Because the monetary situation of 2008 and also the resulting Terrific Recession, nevertheless, gold IRAs have actually ended up being substantially extra prominent. Document gold sales integrated with the look of a lot more business to take care of and also streamline the transactions have actually made spending in a gold IRA a one-stop shop.

"All various other regulations regarding IRA contributions, disbursements, as well as taxes apply," Moy includes. The gold in a gold Individual retirement account have to be kept in an IRS-approved depository; you can not maintain it in a safety and security down payment box, house risk-free, or under your mattress.

More About Gold Ira Companies

This is the capitalist's duty. Established custodians have connections with several hundred dealerships throughout the nation as well as might be prepared to share that listing. It can additionally function the other means. "Some steel dealerships might recommend an IRA custodian," says Johnson. "However, customers are constantly complimentary to look for custodians by themselves." Choosing which business to utilize is made complex, as it is a specialized task that significant brokerage firm companies normally don't offer, according to Moy.: You ought to only deal with a firm that has all the suitable and needed licenses, registrations, insurance coverage, as well as bonds to shield your investment. Possessing gold in a gold IRA does come with some unique expenses.

"Similarly, each kind of gold offers its very own collection of demands when a capitalist has to market," he adds.: This one-time fee is credited develop your new IRA account - gold IRA companies. This additionally differs by institution, however it might be greater than the common arrangement charge, as not all economic solutions firms take care of gold Individual retirement accounts.

: The gold needs to be held by a certified storage facility for which storage space fees are charged.: If you intend to liquidate a gold individual retirement account by offering your gold to a third-party supplier, stated dealership will certainly intend to pay much less than what it chooses on the open market.

Gold Ira Companies Can Be Fun For Everyone

Some individual retirement account firms will assure to buy the gold back from you at existing wholesale prices, but you could still shed money by shutting the account, something that generally doesn't occur with opening as well as closing regular IRAs. Once you get to age 72, you will be mandated to take needed minimum circulations (RMDs) from a traditional gold IRA (though not from a Roth one).This issue, nonetheless, can be relieved by taking the complete quantity of your RMDs from various other traditional IRAs. There is one possible means to avoid having a custodian and also the prices connected with one: You can open what's called a "checkbook IRA," a self-directed individual retirement account that does not call for custodial administration.

The explanation rollover procedure coincides as for any type of various other retirement fund. You normally load out an account application (whether online or theoretically), and the account is usually established within 24 to two days of conclusion and invoice of the application. "As soon as the authorized transfer request is received by all parties, the 2 custodians will certainly connect with each other to move the funds to the brand-new custodian and also fund a new gold IRA," claims Gottlieb.

"You recommend them as to the specific useful source kind you desire to acquire as well as prices are secured back then," adds Gottlieb. All investments feature threats and also rewards, gold consisted of. "In lots of ways, gold Individual retirement accounts have the same dangers that any type of financial investment has," says Moy. "The price of gold can go up or down and also have volatility.

The Greatest Guide To Gold Ira Companies

So if your profile is balanced with both gold and paper-based financial investments, a loss on the gold side will certainly be stabilized by the gain experienced by other possessions. "Several of these risks visit this site right here exist for conventional IRAs as well. As well as typical Individual retirement accounts have dangers that gold IRAs do not have," he adds.Any type of physical commodity is subject to theft. Somebody could get into the vault where your gold is being saved. Nevertheless, to receive gold Individual retirement accounts, depositories are required to be insured, which would certainly shield your financial investment as long as your account does not exceed the custodian's stated value on accounts, "There are also undependable custodians that could take from their clients' accounts or devote fraud by selling your rare-earth elements that they do not in fact have neither are planning to buy," claims Moy.

Report this wiki page